The United States and France have established public funds that invest in innovations addressing the needs of poor people. These social innovation funds, characterized by an open, tiered, and evidence-based approach, have already benefited more than 100 million people and could be a powerful tool in reducing global poverty.

Innovation can have a profound effect on our lives. Thanks to technological advances that reduced the price of solar energy by nearly 90% between 2009 and 2019, the green-energy transition is within reach. Likewise, agricultural innovation has helped to triple the amount of food grown per hectare since 1960, dramatically reducing hunger even as the world’s population more than doubled. And mRNA vaccine technology has saved countless lives during the COVID-19 pandemic.

Societies have established various mechanisms to encourage innovation. One is the market system: companies pay for research and development in the hope of selling innovations at a profit, and investors back companies if they think their products or services will sell. The patent system encourages R&D by protecting original inventions from being copied. And government funding supports basic science, which is critical to driving innovation but difficult to patent.

While these mechanisms foster innovation, they are not perfect. In some areas, commercial investment incentives fall far short of what is required, and the needs of the poor too often go unaddressed. Certain innovations, such as emissions-reduction technologies, benefit everyone rather than the customer. This means that their price does not fully reflect their value to society, reducing private companies’ incentives to develop them. Other innovations are difficult to patent and too easy to replicate, which limits the potential rewards for developers.

Similarly, there is a need for innovations that improve how governments deliver essential services, such as teaching children math or protecting vulnerable individuals and communities from climate change. But such innovations are often difficult to monetize.

As a result, innovations aimed at serving the poorest segments of society are frequently overlooked. To mobilize investment in projects designed to assist those living in poverty, we helped establish social innovation funds in the United States and France. Development Innovation Ventures (DIV) at the US Agency for International Development, and the Fund for Innovation in Development (FID) at the Agence Française de Développement both take a page from venture capital’s playbook, but focus on currently underserved areas.

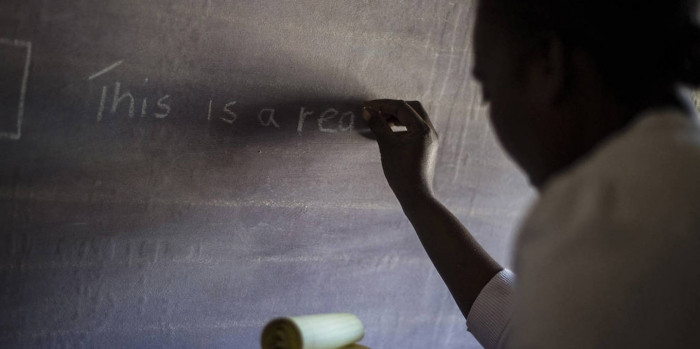

These funds identify innovations that can be scaled up, either by the agencies hosting them or by other governments, NGOs, or private companies. For example, DIV’s early, relatively modest investments in targeted instruction in India provided the necessary proof of concept that facilitated the Zambian government’s almost-nationwide expansion of the model, with assistance from the US government. It also proved instrumental in securing $25 million in complementary philanthropic support to help scale this innovation further. Millions of children in a dozen African countries now reap the benefits of these highly effective pedagogical programs.

This approach has been enormously successful. We recently analyzed the impact of the first two years of DIV investments, which included software to support community health workers in delivering basic services, water-treatment dispensers, and affordable glasses for presbyopia. Innovations funded by DIV during this period have affected more than 100 million people and generated at least $17 of social benefits for every $1 invested. This represents a social rate of return exceeding 143%, nearly ten times the initial 15% target set at DIV’s inception.

Much like venture capital, a handful of “superstar” innovations account for most of the benefits. For both venture-capital and social innovation funds, the majority of innovations have modest impacts or do not pan out, but a few big successes can justify the entire portfolio and drive returns. Nine of the 41 innovations funded by DIV in its first two years reached more than one million people. We were able to put a dollar value on five of them. By 2019, these five innovations generated $281 million in social benefits, representing a seventeen-fold return on the entire portfolio, including administrative costs.

Given the riskiness of investments in innovation, there is always the fear that a fund could fail to identify the superstars or overcommit to mediocre or failed projects. DIV and FID have four key characteristics that have enabled them to avoid this and generate robust returns on their investments.

First, DIV and FID are open. To identify promising innovations, both funds are agnostic about where success occurs, casting a wide net across sectors and entities. They welcome applications from researchers, private-sector firms, NGOs, and governments. This includes applicants who often struggle to win government contracts, such as those based in low- and middle-income countries.

Second, to maintain discipline in investment decisions, DIV and FID employ a tiered funding approach. Initially, they offer smaller amounts of funding to pilot and test promising new ideas. Innovations that have undergone rigorous impact assessment and proven their cost-effectiveness are then eligible for additional scale-up funding. This model allows for experimentation while ensuring value for money.

Third, DIV and FID rely on rigorous evidence-based criteria to select the innovations most suitable for scaling up. They often use randomized evaluations – the same methodology used to test new vaccines – to assess the potential of promising projects. This enables researchers to measure the effect of these innovations on incomes, health, literacy, and other important indicators.

Lastly, DIV and FID complement commercial R&D investments. Private companies often invest in innovations that generate social benefits, but typically only if they also expect commercial returns. By contrast, DIV and FID focus on innovations that yield significant social benefits but have limited commercial viability. Social innovation funds can also de-risk under-served populations or geographies, crowding in private investment alongside grant capital. This makes their investments truly “additional”: they invest in projects that would otherwise remain unfunded by the private sector.

At a time when aid budgets are under renewed pressure, one way to maximize the impact of spending is through open, tiered, evidence-based social innovation funds like DIV and FID. The evidence suggests that such funds can deliver tremendous returns on investment and avoid throwing good money after bad. By identifying, testing, and rapidly scaling up the most promising innovations, they provide a powerful tool for reducing global poverty and achieving other socially desirable goals.

Michael Kremer, a 2019 Nobel laureate in economics, is University Professor in Economics at the University of Chicago, Director of the Development Innovation Lab, and Scientific Director of Development Innovation Ventures.

More about: