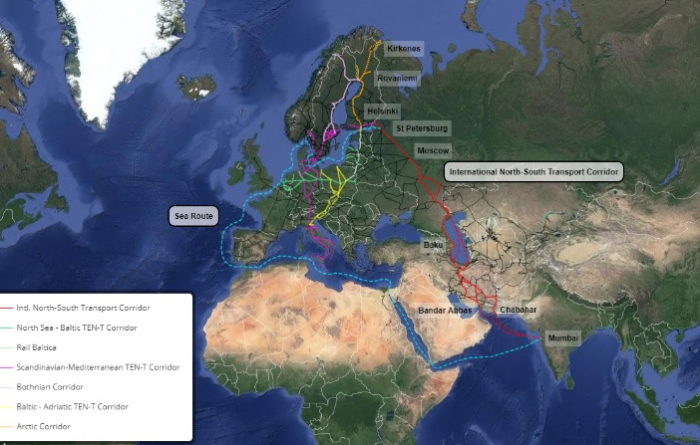

- The North-South ITC runs in three routes – the Western through Azerbaijan, the Trans-Caspian through the Caspian Sea, and the Eastern through Kazakhstan. Which one of these three do you find the most profitable and attractive?

‘There is no definite answer to this question today. The shipped containers are what is going to produce the maximum benefits to the corridor participants, and so far, they are mainly transported along the western branch that runs through Azerbaijan. The quantity of the containers delivered through the North-South ITC is indecently small currently, totalling around 22 thousand 20-foot containers in 2022. Although, we have been noticing a positive trend in this segment this year. As soon as the figure approaches around 300-500 thousand a year, the route will become extremely profitable for all the transit states, primarily for Azerbaijan, occupying the central spot along it.

The Trans-Caspian sea route running from the Port of Olya in Russia to the north Iranian Anzali port is excellent for shipping heavy cargo, including rolled metal, fertilizers, cement, carbonite and ferroalloys. There is not much demand in conveying this cargo through the North-South corridor, which is why the cargo turnover along the ‘middle’ sea route grows the slowest. It has been generating losses, not gains, for the investors so far.

The eastern land route from Russia through Kazakhstan, Uzbekistan, and Turkmenistan to Iran has been registering the fastest growth rates of cargo shipments in 2022-2023. There is a simple explanation behind it: They have been operating a railway along the route since the USSR. It is still in good condition and capable of transporting heavy goods in bulk, including in containers. The traffic growth along the route will slow down, as it is located on the periphery of the most optimal and shortest route from the Indian Ocean to Russia, further opening to Europe.

All three routes are still not attractive for carriers, since they also imply prolonging cargo delivery times along the established two routes, through the Suez Canal and Trans-Siberian Railway from China to Europe. Since all three of these transport corridors are only just taking tangible shape, shippers may face risks of reduced quality in transport services due to underdeveloped infrastructure for transshipment and cargo storage and lack of specialists capable of quickly handing large volumes of all types of international cargo. All these problems will certainly be solved, but it will take another 5 to 10 years.’

- Which one of these routes is more economically attractive for Russia?

‘Russia will prioritize the west branch running through Azerbaijan, since it opens to densely populated southern regions of the country and the industrial centres in western Russia, such as Moscow, St. Petersburg, and the Volga region. Employing the route at full speed will require many more years and huge investments, which remain without a definite source.

The North-South corridor was of little interest for the Russian business and government structures before imposing what the West considers the most painful sanctions. Everything changed in February 2022, when the transport sector of the Russian economy was hit by sanctions targeting to ruin it. The plan fell through, but Moscow now faced new and urgent tasks, along the routine ones, for developing the transport industry. Thus, Russia decided in spring 2023 to allocate over 250 billion rubles by 2030 to improve the transport-logistics infrastructure at its own portion of the North-South ITC, primarily to modernize the railways, build terminals, customs and sanitary control points, and purchase equipment for goods transshipment and storage. The North-South ITC is currently one of the central links in reorienting the Russian national economy away from the European markets and towards the economies of the Middle East, the Indian Ocean, and Southeast Asia.

The headache with the western route is the insufficiently developed transport and logistics sector in Azerbaijan and the truly archaic transport network in Iran. Azerbaijan has already made all the major decisions to develop the national transport and logistics complex, so what remains is the implementation, such as building customs terminals, integrating the data system to those of neighbouring states, and train logistics specialists. Iran has only started modernizing its road network.’

- What is North-South ITC’s cargo potential?

‘Political and other factors are having an extraordinary influence on the fate of the ITC. Late 2020 was the year of global surge in freight rates, primarily containers, due to the Coronavirus pandemic and doubts whether the transport-logistics industry can operate without disruptions under emergency conditions. The exorbitant prices for transporting services, which broke a record in global economy, lasted a little more than a year and gave way to a decline, which even resembled a fall, in autumn 2021. But Russia’s special military operation in Ukraine has become another cause for instability in transport services, highlighting the ‘Russian segment’, which naturally made the fixed costs for cargo transport grow even against the backdrop of overall drop in prices.

Russia’s revived interest in the North-South ITC is dictated by these two factors, sanctions primarily. For Russia, transit safety currently comes before its economic profitability. Moscow is ready to invest heavily in developing transport corridors, which would connect them to the outside world. The 1.3 billion USD allocated in 2023 from the Russian budget to complete the missing portion in the Iranian railway network (at the Astara-Rasht section) is a suggestive illustration of this thesis. However, as emergency circumstances cease to threaten the Russian economy, the Kremlin’s interest in investing in Iranian roads may wane.

As for Iran, the real agenda is to rebuild the transport network in the country, especially in the northern regions, anew. The experts have estimated that the ground transport infrastructure in Iran requires an immediate investment of 20-25 billion USD. The existing railways there are narrower (1435 mm) compared to the Russian standards (1520 mm). The railways in Iran had been built by the British to transport lighter goods, particularly for carriages weighing no more than 30 tons, which is twice as less as the cargo capacity on the railways built in the USSR and Russia. Iran also needs to upgrade a significant portion of the highway network, build new port complexes and terminals, develop an ecosystem of forwarding companies, train lawyers, drivers, phytosanitary control specialists, and so on. This is a gigantic endeavour, which can be fully accomplished only with a guarantee of a return on investment. These guarantees are simply impossible to achieve today due to the specifics of the South Caucasus, related to security threats and the risk of not being able to compete with alternative routes for good delivery.

The freight traffic along the North-South ITC grows fastest along the East route, as it already has the launching conditions to boost the volume of transported goods. At the same time, there are several factors that make this market segment problematic for investors, such as 4-5 reloads of transported goods or containers, a change in the railway gauge when moving from Turkmenistan to Iran, lack of infrastructure habitual for Russian and non-regional carriers, the inconsistency of the parties on document flow, and registration of ‘sensitive goods’. The parties do not even have an agreement on the language of business correspondence within the North-South corridor.

This makes the preliminary calculation of the efficiency of investment and routes of the North-South ITC simply unfeasible. The budgets of interested states while deciding on financing the actual construction of the ITC, do not yet have the scope to assess the return on proposed investments. The possible gain seems tangible for Russia so far. Their economic war with the USA and their allies will go on for several more decades, which makes having a reliable transport-logistics route ‘south of Moscow’, meaning to the South Caucasus, the Middle East and India/Pakistan, strategically important for Russia. Another obviously interested party is Iran, who has been subjected to sanctions for over 40 years. As for all other states (Azerbaijan, Kazakhstan, Turkmenistan, and a number of others), they must be prepared for two challenges:

1) a fierce price competition in the global market and constant improvement of the service quality while transporting goods,

2) clear understanding that the North-South will produce substantial and easy profits only in the event of operation failures at the Suez Canal or substantial boost in export of industrial goods from India to Russia, EAEU countries and North Europe.

More about: