| The Analytical Group of AzVision.az |

At the Junction of Three Roads | Long Read// Which route of the ‘North-South’ corridor is the most lucrative? |

|

Russia has drastically altered its foreign trade

priorities since being hit with unprecedented sanctions from the West. Eastern

countries, China and India ahead of the pack, have turned into Moscow’s primary

trade partners. Trade turnover between Russia and India has exceeded 35 billion

USD, growing by 46.5% in 2021 and 2.5 times in 2022. While Russia was Iran’s

seventh largest trading partner, it has risen to the fifth spot as of February

2023. Turnover between Russia and Iran has reached 4.6 billion USD, multiplying

by 15% in 2022.

Such drastic turnover growth requires reliable and

efficient corridors for goods transportation. The traditional trade routes from

India to Russia run through the Indian Ocean to the Red Sea, thus opening to

the Mediterranean Sea through the Suez Canal and reaching Russia via the Strait

of Gibraltar, the Atlantic Ocean, the English Channel, and the North and Baltic

seas. The containers complete this journey in 30 to 45 days, whereas there

is an option that allows cutting the voyage by 25%, reducing it to 15 to 24 days .

It is the North-South International Transport Corridor (ITC). |

|||

-1689585657-1696578245.jpg) |

|||

| Each ton of cargo transported through the North-South corridor costs $2,500 less |

The 7200-kilometer North-South Corridor is lucrative in terms of saving not only time but also the cost of transporting goods. It will allow cutting costs by 2,500 USD per ton of cargo transported through it. So, why isn’t this corridor operating at full capacity? What is the obstacle on its way? Time Lost A group of shipping companies from India, Russia, and

Iran signed an agreement in 1999 to deliver containers to Russia via Iran and

the Caspian Sea. The agreement evolved into an intergovernmental agreement

at the Second Euro-Asian Conference on Transport in St. Petersburg on September

12, 2000. Several hundred containers had already been shipped through the

route by 2002. Yet, the technical problems with infrastructure, logistics,

customs control, and others in Iran proved it to be not as easy as initially

thought. The interest in the project gradually waned, leaving only the

Russia-Iran portion of the corridor operational.

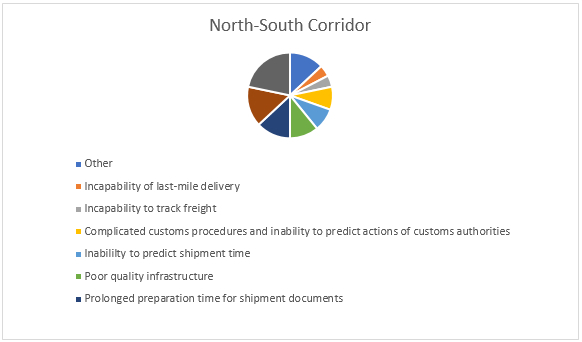

All-Russian Academy of Foreign Trade conducted a survey in 2019 on the disadvantages of the North-South corridor and the participants showed the following as the main problems:

Now everything depends on which of these problems

have already been, are being, or will soon be solved.

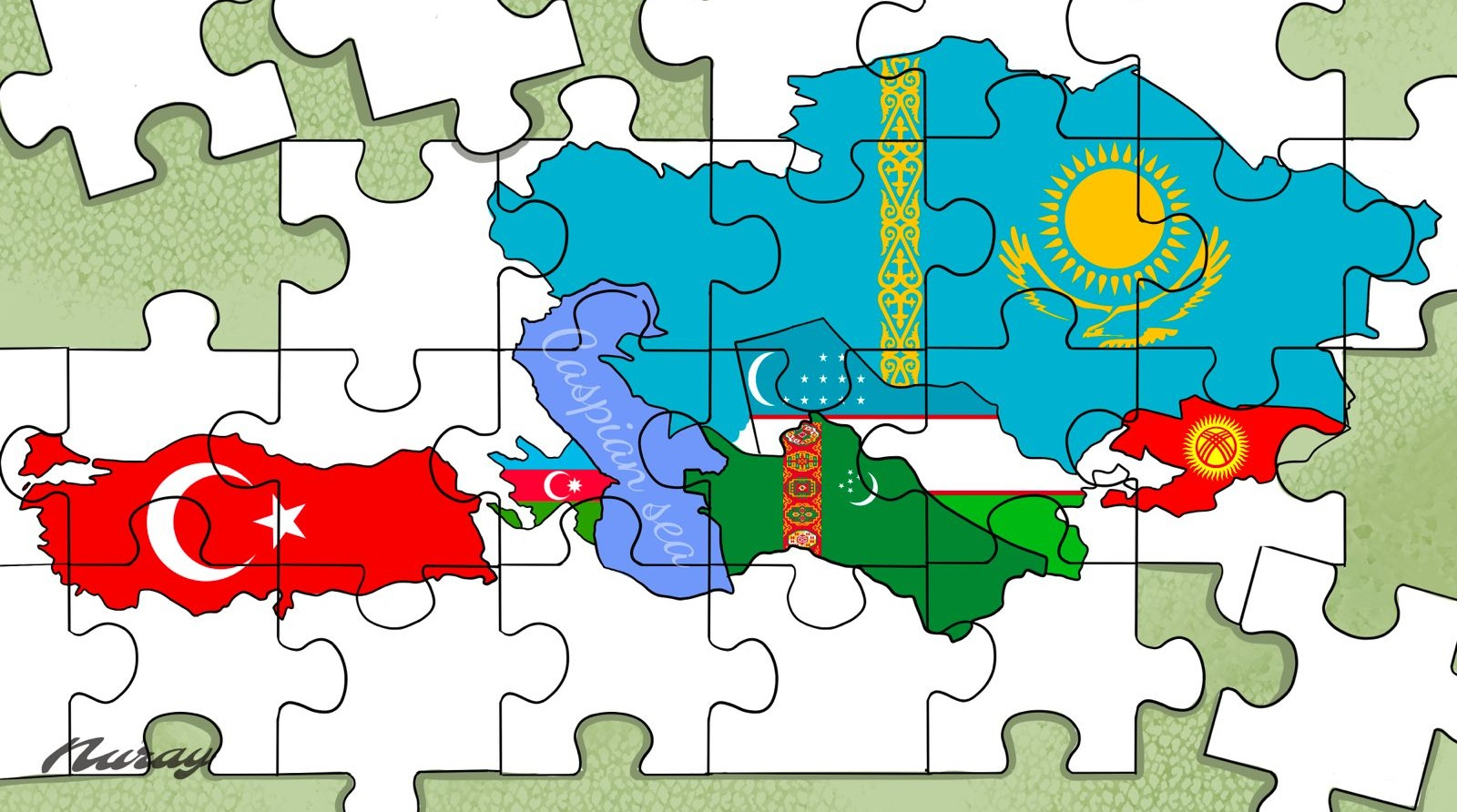

The rapid development of the North-South corridor currently requires the solution of a trilemma. The freight from India enters Iran from the south and moves further to the north of the country via train and trucks, which requires choosing one of three options. · The Trans-Caspian route, which connects Iran’s Anzali, Noshahr and Amirabad ports to Russia’s Astrakhan, Olya and Makhachkala ports. Azerbaijan’s Baku and Alat, Kazakhstan’s Aktau and Kuryk, Turkmenistan’s Turkmenbashi ports also take part in the process to a certain extent. |

||

|

|||

| The routes running through the Caspian Sea come with many challenges, not visible at first glance |

· The Eastern route provides railroad access from Iran to Turkmenistan via Sarakhs border terminal, finally opening to Russia through Kazakhstan. Another route goes in the direction of Incheh Borun (Iran) – Agyayla (Turkmenistan). · The Western route where the freight entering Azerbaijan from Astara is carried through the country by road and rail to reach Russia through the Samur-Yalama border crossing point. Which one of these routes is the most lucrative? The Orient is an Enigma The British built most of the

existing railway network in Iran back in the day, which is why the gauge

there (1435 mm) is narrower compared to Russian standards (1520 mm).

The railways in

Iran had been built for carriages weighing no more than 30 tons, which

is twice as low as the cargo capacity on the railways built in the USSR and

Russia. The railways in northern Iran (Tabriz-Julfa for instance) correspond

to the 1520 mm standard since they had been constructed by the USSR. Iran also needs

to upgrade a significant portion of the highway network, build new port

complexes and terminals, develop an ecosystem of forwarding companies, train

lawyers, drivers, phytosanitary control specialists, and so on.

Factors, such

as changes in the railway track when crossing to Turkmenistan, 2-3 reloads of

transported goods or containers, lack of infrastructure habitual for Russian

and non-regional carriers, the inconsistency of the parties on document flow,

and registration of ‘sensitive goods’ become significantly problematic. The parties also do

not have an agreement on the language of business correspondence. |

||

-1696582725.jpg) |

|||

| Deserts are not exactly a suitable landscape for trains |

The road from

Kazakhstan directly to Turkmenistan, bypassing Uzbekistan, and opening to Iran

was launched in 2014. But the real situation is that the roads between

Turkmenistan and Kazakhstan are not without problems. this line takes 2 days

longer than the Western route and is relatively more expensive. As

Turkmenistan is a closed country, the complexity of border-crossing procedures

leads to time loss and a drop in the quantity of transported freight. The desert

also often disrupts the work of the railways. The output capacity is also

limited with only 10 million tons a year. And only a small fraction of

that has been carried out so far. To add insult to injury, the Taliban seizing power in Afghanistan has raised concerns about the safety of this road. What about the

Ships?

In

2003, Russia began installing a railway line to the northern Caspian port of

Olya, which was completed in 2004. 5,700 wagon loads of cargo were sent to Iran

from Olya in the first 6 months of 2010. But for the past 20 years, the

north-south route in the Caspian has not proven efficient in terms of cargo

shipment. |

||

|

|||

| Port-Olya-2 cargo ship docked at Olya Port |

The advantages

of the sea routes over others could be the involvement of two countries

only, meaning fewer border crossings. However, there are a number of

factors that deem this route rather questionable. Seaway is the most

time-consuming option for freight transportation. Russia does not have a container

fleet, operational container lines, and terminals at hand in the Caspian

Sea. Transport vessels are considerably worn out. They have also not built

services to secure the continuity of sea trade. These problems may grow even graver

in the future. ‘The

Caspian is receding, which is more visible towards the north of the sea, which

is shallower. The dead weight of the ships arriving at those ports was already

low enough, but they were going to drop even more. The

ships can enter these ports half-loaded, which is not feasible in terms of

efficiency’, says Rauf Aghamirzayev, a transport and logistics expert,

in his interview to AzVision.az.

The expert believes that the north shore requires some

expensive jobs done: the seabed needs dredging, and the structure of the

Astrakhan port expanding. Moreover, the Volga-Don canal also needs

dredging. Every canal has its own unique cargo ships, such as the Panamax ships

for the Panama Canal, and Bosporus-Max for the Bosporus Strait. The Volga-Don max

vessels did not have a large carrying capacity to begin with. |

||

| Rauf Aghamirzayev: ‘The most important thing is for the sanctioned cargo not to pass through our territory’ |

The Trans-Caspian Sea route running from the Port of Olya in Russia to the north Iranian Anzali port is excellent for shipping heavy cargo, including rolled metal, fertilizers, cement, carbonite, and ferroalloys. Currently, there is not much demand in conveying this cargo, which is why the cargo turnover along the ‘middle’ sea route grows the slowest and does not produce income yet. On the contrary, it has only been damaging the investors. All Roads Lead

to Azerbaijan Customs

services of Azerbaijan, Russia, and Iran signed a memorandum of understanding in August 2022 to facilitate the

circulation of transit goods between Iran and Russia by directing them through

Azerbaijan. The document will synchronize the operations of customs

authorities, accelerate data exchange, and reduce queues.

The

newly built Khanoba Customs Border Checkpoint on the Azerbaijan-Russia

border was presented in May 2023. This is a rather large infrastructural unit:

13 control lanes will have the capacity to serve 550 trucks, 1000 passenger

vehicles and 30 buses a day in both directions. Passport control and customs

registration will also be based on the one-stop-shop principle. |

||

|

|||

| The newly opened customs checkpoint in Khanoba |

Such a large

infrastructure was obviously not introduced to only assist cargo circulation

between Azerbaijan and Russia. Jafar Guluzadeh, chief of department at the

Organization of Customs Control Head Department, says that ‘as Azerbaijan transforms into an international

transport hub, the customs control services must also continuously keep up in

development and improvement across the country, and customs Checkpoints are the

main components on the transport corridor’. Something else

of great importance happened in May 2023: Russia and Iran signed an

agreement to construct the Rasht-Astara railway line. The commissioning of

the 162-kilometre line in 2025 will indicate the completion of the Western

route of the North-South ITC. Russia allocating a loan of 1.3 billion USD

at a time of financial hardships is an illustration of how important the

project is for them. Azerbaijan had also allocated a 500 million USD loan to

Iran back in 2018 for the same purpose. India has invested 2.1

billion USD in developing transport infrastructure in Iran. Azerbaijan has

been upgrading the Alat-Astara railway within its territories since 2019.

The 1.19 billion USD project is anticipated to be finished by 2027. A 166-km

portion of the Sumgait-Yalama railway is also being modernized. The

$200-million project is scheduled to be completed in 2024. We are also

boosting the throughput capacity at the Samur railway crossing point.

The adjacent Derbent railway crossing in Dagestan is also being reconstructed

simultaneously.

Azerbaijan Railways reports that there was a 90%

increase in rail freight transportation within the North-South Corridor in 2022,

totaling 700 thousand tons of cargo. As all the underway projects are finished, the cargo volume is prognosticated to leap by 15% at first and reach a

whopping 30 later. |

||

|

|||

| Cargo delivered through Azerbaijan costs 10 to 15 percent cheaper than through other two routes |

In spring 2023, Russia decided to allocate over 250 billion rubles

until 2030 to improve the transport and logistics infrastructure on the

Western route of the North-South ITC, passing through its territory. This

clearly illustrates that the Western route has snatched the priority,

whereas the eastern branch of the North-South used to be considered the main

one. There are several reasons behind this: · Firstly, Azerbaijan is a country, that is open to

cooperation with all parties. · Secondly, becoming an international transport hub is

one of the goals the country strives for, and has been improving the

domestic infrastructure correspondingly. The country is working on not

only the domestic one: Azerbaijan has installed a railway from Astara to

Iranian Astara and built a terminal, through leasing 35 hectares of land in

Astara for 25 years. · Thirdly, and perhaps most importantly, there is no

other country to propose cutting the distance between Russia and Iran to 500

kilometres. Shortening the distance makes transferring goods through the

Western route of the corridor much cheaper by 10 to 15%. This is an

especially cogent argument at a time when logistics costs are skyrocketing

around the world. About 85% of cargo, entering Azerbaijan, is transited to other countries, which illustrates Azerbaijan’s accumulated experience in acting as a transport hub. This know-how will come in extremely handy while operating the North-South ITC. 3 in 1 One of the North-South routes being more accentuated does not rescind

the other two. All three branches of the corridor will be employed because

each caters to a unique destination. However, the Western route running through

Azerbaijan will stand more prominent. There are several other crucial

reasons besides what we have already mentioned so far: the route through

Azerbaijan is also an exit to the West. India and other participant

countries in the corridor are all interested in delivering their goods to the

West.

Economy expert Khalid Karimli says in his interview to

AzVision.az that although the corridor runs in three separate

directions, the North-South should be viewed as one project and all

participating countries can, in fact, join all three routes. For instance,

Azerbaijani ships could carry goods from Iran to Russia through the

Trans-Caspian route of the North-South corridor. |

||

| Khalid Karimli: ‘All participating countries will benefit from the launch of the corridor’ |

The recent transshipment dynamics in the Baku port also prove the point.

The port has informed AzVision.az, that while comparing 2021 and 2022

figures, the overall volume of transported cargo grew by 13.7%, the number of

wagons by 27.2% and the number of containers by 16.1%. Russia will spend 280 billion rubles overall by 2030 to further

the development of the North-South ITC. The Eurasian Development Bank informs

that it is planned to invest 38.2 billion USD into all three routes of the

corridor, to be distributed as follows: 69% to the Western route, 11.1%

to the Eastern, and another 19.2% to the Trans-Caspian branch. All three North-South corridor routes overall transported 13.8 million

tons of freight in 2021. The Russian government prognosticates the number to

reach 32.5 million by 2030. The corridor facilitated around 22 thousand 20-foot containers in 2022, most of them passing

through Azerbaijan. As the number of delivered containers approaches 300-500

thousand annually, all transit countries will benefit profoundly.

…No wars, conflicts or sanctions last forever. There

will one day come an end to the military operation in Ukraine, the sanctions

against Russia and Iran, and even the international isolation of these states. The

roads installed and infrastructure built, however, will remain and benefit all

parties for much longer. Therefore, these cases require a cooperative, not

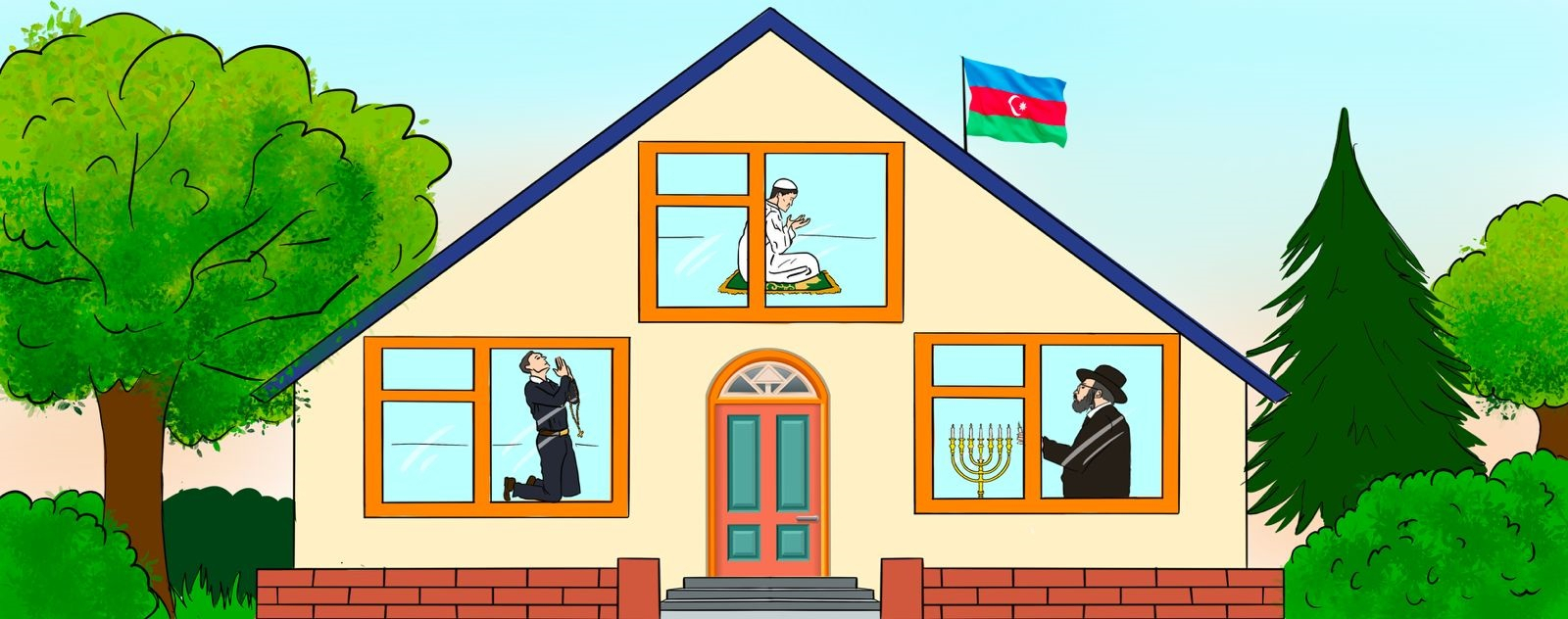

confrontational, point of view. Just like Azerbaijan does. |

||

-1728294271.jpg)

-1680010126.jpg)