Chinese President Xi Jinping was warmly welcomed when he visited Europe in March 2019. The Chinese leader began that trip in Rome, where he was feted as Italy became the first member of the G-7 to sign on to China’s trillion-dollar Belt and Road Initiative (BRI).

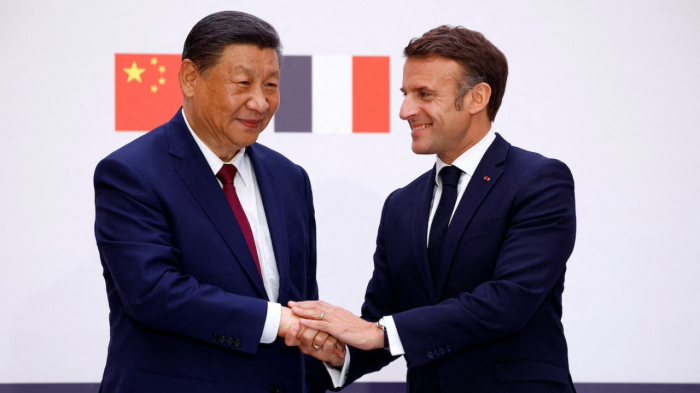

In France, President Emmanuel Macron arranged for a mini-summit by inviting the Chancellor of Germany — China’s most important European trade partner — and European Commission President Jean-Claude Juncker to meet jointly with Xi. While Macron pushed the new EU strategy favoring multilateral instead of strictly bilateral ties, French businesspeople also signed some $40 billion in contracts, including for the purchase of 300 Airbus airliners.

Those were the days. Chinese investments in Europe had reached €150 billion, as national governments were eager to spur domestic growth. European firms were lining up to get into the Chinese market and EU-China trade exceeded €500 billion annually, with a hefty balance in China’s favor. Given the diplomatic slaps by President Donald Trump, Europe’s leaders were exploring ways to stand on their own in dealing with the world’s second-largest economy. Among the newest EU members in Central and East Europe, China successfully sponsored a partnership there that grew to 17 states by 2019.

Five years on, the expectation of “win-win” cooperation has been replaced by what might be termed “Sinosceptisicm.” Domestic and international changes have created a much colder European environment, one that Xi will only discretely sample on this visit.

Globally, the effects of Covid, exacerbated by China’s draconian lockdowns, slowed international trade and contacts between Europe and China. At the same time, a more prominent Chinese presence in Europe spurred businesses, and the EU, to complained about “imbalances,” unfair trade practices and discriminatory treatment of investors. A comprehensive EU-China investment treaty designed to address such issues was laboriously negotiated and then sunk by the European Parliament in 2021. The U.K. — a leading Chinese partner — left the EU the same year. Beijing’s efforts in East Europe collapsed, except for good ties with Hungary.

Domestic change also had significant impact. Taking power in Italy in 2022, Prime Minister Giorgia Meloni’s new government shed its coolness toward Europe and reinforced a Sinosceptic trend begun under her predecessor, Mario Draghi. Rome repeatedly blocked Chinese investment in key industries and withdrew from the BRI in late 2023. The Meloni government strongly supports America’s views on freedom of the seas in the South Pacific and is backing that up with plans to deploy an aircraft carrier to the area. Xi is not visiting Italy on this trip, stopping in China-friendly Hungary and Serbia instead.

At the supranational level, a changing of the guard in Brussels has produced a leadership eager to put flesh on the bones of the EU’s strategic vision of China as a “systemic rival.” Brussels has undertaken multiple investigations of Chinese subsidies or other unfair practices supporting the export of electric vehicles, solar panels and medical devices to Europe.

In the U.S., Trump’s defeat allowed the decidedly more Europe-friendly Biden administration to be a partner for mutual concessions on trade and plans for greater transatlantic cooperation on issues of high technology dangers and investment screening. Leaders in Europe and the U.S. face difficult election seasons, and the desire to be “tough on China” is creating a much different environment than Xi encountered five years ago.

This shift comes at a bad time for the Chinese leader. Weak growth rates, depressed prices and a now wary foreign investment community undermine Beijing’s capacity to keep providing its citizens with a better life. The dilemma for Xi is how to keep up the growth of earlier years without provoking trade wars with global rivals. Right now, China has both overproduction of industry and underproduction of people. The country’s birthrate is well below replacement levels but has yet to force needed — and expensive — policy changes.

These dynamics underlie Xi’s use of nationalism as a substitute for increasing prosperity; China’s assertive territorialism in the South China Sea and a renewed campaign directed at Taiwan both cause concern in Europe.

But the most acute issue for Europeans is China’s stance on Russia’s war in Ukraine. Notwithstanding its pretensions as a champion of the less powerful, Beijing has echoed Moscow’s justification for the war, blaming the U.S. and NATO. Professing neutrality, Xi has done little to hasten the war’s end. On the contrary, China has become the major purchaser of oil and gas that Russia cannot sell elsewhere and provides technology and manufactured and consumer goods to Russia. Most worrisome is the trade in machine tools, microelectronics and drones that, according to U.S. intelligence, make possible Russia’s war effort.

EU leaders have been blunt about their disappointment in China’s position and will likely urge Xi to take a more active role in ending the war. Public attitudes toward China in Europe have moved in a decidedly negative direction since Xi’s last visit, a trend reinforced as European publics endure fuel cuts in their homes and businesses due to sanctions against Russia.

Major breakthroughs are quite unlikely in such a milieu. EU-China summits have in the past produced “candid” and “frank” discussions along with not-so-oblique criticisms. In 2022, EU High Representative for Foreign Affairs Josep Borrell labeled these “a dialogue of the deaf.” At this point, the factors binding Europe to the U.S., and China to Russia, seem changeable only at the margins.

But margins count. Trade and investment issues, while nettlesome and closely linked to domestic politics, are the most favorable. Promises can be made, “gentlemen’s agreements” signed to avoid damaging mutual trade and trust. Joint commissions — of which the EU and China already have plenty — can gear up to study issues like equal access for foreign investment.

Such small steps may not make the kind of headlines that Italy’s joining the BRI did five years ago, but in the current Sinosceptic environment, they might be useful and welcome.

Ronald H. Linden is a retired professor of political science and director of European Studies at the University of Pittsburgh.

The original article was published in the Hill.

More about: