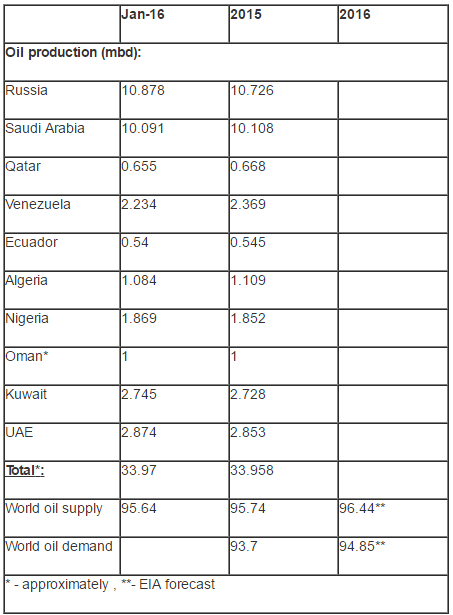

Russia, Saudi Arabia, Qatar, Venezuela, Ecuador, Algeria, Nigeria, Oman, Kuwait and UAE are the countries who called for the freeze in the first place. Actually the amount of project`s participants is claimed to be 15+ countries, the above countries are the ones being mentioned the most.

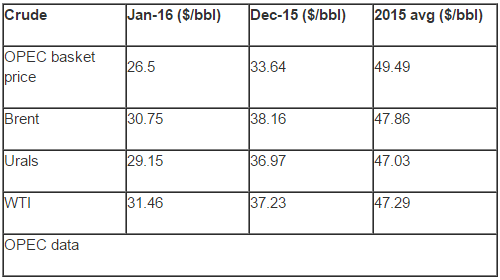

So what is the main point of the oil production freeze, and why exactly at the January-2016 level? The oil market glut started in September 2014; the main world oil producers still continue to bull the market. This extended glut bulled the oil market in January by 30.75 dollars per barrel for Brent.

The similar situation happened in January with the price of the other main crudes including the OPEC basket, WTI and Urals. Realizing what is going on, some countries, including Saudi Arabia and Russia announced the start of the oil freeze production project.

Those in the oil industry know that traditionally the first quarter is the only one during the year with the least of world oil production. The US Department of Energy`s Energy Information Administration (EIA) expects 95.6 million barrels of oil production per day within the first quarter, 96.6 million barrels per day in the second and third, and 96.8 million barrels per day in the fourth quarter 2016.

Thus by freezing the oil production on the 95 million barrels/day level, the project`s participants can lower down the oil market glut, since the demand for oil is rising in the third and the fourth quarters.

During the first quarter, the EIA expects 93.73 million barrels per day of world crude demand, 94.5 million barrels per day in the second, 95.64 million barrels per day in the third, and 95.5 million barrels per day in the fourth.

The oil production freeze project participants will try to drag the January oil prices up to the average level of 2015, by sustainable oil production amid the seasonal oil demand growth.

In fact the Project outcome will be perceptible in the market in July-September 2016 only. The project will show results in case of all the participants complying with the production quotas. Some market analysts believe it is unlikely to happen, considering the rally of quotas among the OPEC members.

The world oil prices fell by more than 38 percent in January 2016 as it shown in the table below:

The total share of the project`s participants in the world oil production is some 35-40 percent, and that`s big enough to manually control the market. Yet, there are still those who don`t buy into the oil production freeze idea, they`re not joining the project.

One of those is the US, although they`ve declined the oil shale production because of the bearish market. So, on one hand, the oil production freeze project can bull the market and provide sustainable production, and on the other hand it gives a brilliant opportunity to the US to recover the shale oil production after the oil price rise.

The same can be applied to Iran, which has recently started to flex its muscles after the lift of international sanctions. Tehran says it won`t join any "freeze projects" until its own production reaches 4 million barrels of oil per day.

It seems like many experts don`t buy into the execution of the project mostly because it seems unlikely for the countries willing to lose their market share as opposed to those who wouldn`t join the project.

The list of oil production freeze project participants shown in the table below:

It seems that the participants of the project intend to keep the oil prices at least on the last year`s average level.

Russia’s Economic Development Minister Alexei Ulyukaev told RIA Novosti that the country must be prepared for $40-50 per barrel in the long term. These figures are very similar to the average world oil prices of last year.

The freeze project`s participants produced no more than 33.97 million barrels per day in January 2016, which is the same as the average amount of 2015.

Moreover, there are only 1392 oil rigs that have been operational worldwide in January 2016 - the lowest figure since 2012. Thus, the best outcome from the oil production freeze project would be to reach the average oil prices of 2015.

Vagif Sharifov is an analyst and expert in oil and gas markets.