Embarrassment for IMF as watchdog slams its eurozone record

The IMFs handling of the single currency emergency has been the cause of major internal discontent at the Fund and the IEO verdict will be seen as a vindication of those criticisms.

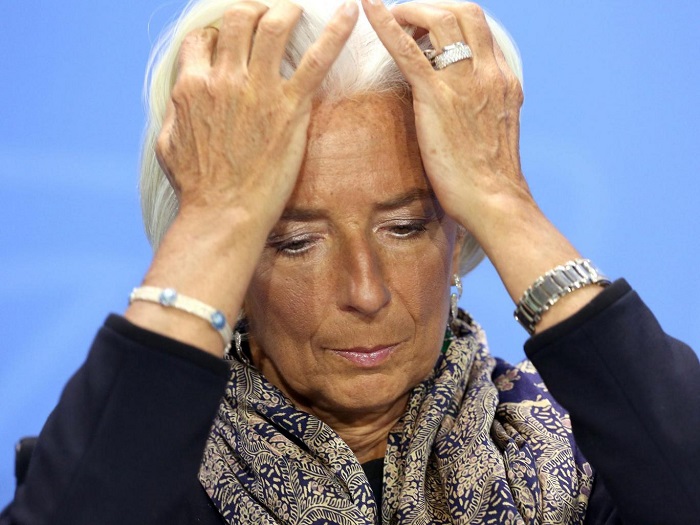

The report is also a fresh embarrassment for the Fund’s managing director Christine Lagarde, who is currently facing trial in France in relation to a corruption case dating back to her time as France’s finance minister in 2008.

The IEO concluded the IMF had “lost its characteristic agility as a crisis manager” in the way it responded to the economic turmoil in the eurozone, which required unprecedented bailouts for several states shut out of the capital markets and looked like it was going to tear the single currency zone apart.

The watchdog also faults the Fund for its “overly optimistic growth projections”, particularly in relation to Greece, and a failure to learn lessons from past mistakes.

Most significantly of all, in a clear indication that the watchdog thinks the Fund’s economic forecasts were unduly influenced by national political concerns, it recommends the IMF’s executive board and management “should develop procedures to minimize the room for political intervention in the IMF’s technical analysis.”

It said: “The credibility of the IMF comes from the technical competence and independence of its staff and the Managing Director must ensure that its technical work is protected from political influence.”

Ms Lagarde, who this year was appointed to a second term as IMF managing director, said she welcomed the IEO report but maintained she still saw the Fund’s performance in the eurozone crisis as “a qualified success”.

She also rejected the IEO’s recommendation the IMF should act to prevent political intervention interfering with its economic analysis saying: “I do not accept the premise of the recommendation, which the IEO failed to establish in its report, and thus do not see the need to develop new procedures”.

Ms Lagarde also rejected the IEO recommendation that the IMF should strengthen its procedures to ensure agreed policies by its board are fully carried through on the ground, calling existing checks and balances “adequate”.

In July 2012 Peter Doyle, a senior and veteran IMF economist, resigned and wrote a scathing letter to the Fund’s board in which he complained of a “European bias” at the top of the Fund that had served to exacerbate the eurozone crisis and also that the leadership had suppressed internal warnings of looming problems.

“After twenty years of service, I am ashamed to have had any association with the Fund at all” Mr Doyle wrote at the time.

In 2010 the IMF contributed €30bn (£25bn) of loans to a bailout of Greece and a further €28bn (£25bn) in 2012. It channelled €22.5bn (£19bn) to Ireland in 2010 and €26bn (£22bn) to Portugal in 2011. The Fund also lent €1bn (£0.8bn) to Cyprus in 2013.

The Fund has been severely criticised for ignoring its long-standing rule that it will not bail out countries unless they immediately restructure their unsustainable public debt piles, and where they have an ability to cushion the adjustment by depreciating their currency.

Ms Lagarde succeeded Dominique Strauss–Kahn as head of the IMF in July 2011 when he was forced to resign over rape allegations. There have been widespread suspicions that both she and Mr Strauss-Kahn, as Europeans, did not apply the usual IMF standards of conduct when faced with a crisis on their own Continent and that they did so because this would have put pressure on powerful eurozone states such as France and Germany.

In particular with Greece, the IMF stands accused of signing off on growth projections that were widely recognised to be incredible in light of the massive spending cuts that were being mandated by the rest of the eurozone and the failure of the European Central Bank to ease monetary conditions.

Greece’s GDP remains 22 per cent, below where it was on the eve of its 2010 EU/IMF bailout and unemployment is still at 23 per cent.

The IEO has a record of producing uncomfortable reports for the Fund.

In 2014 it criticised the IMF for its enthusiastic support in 2010 for a major shift across the advanced economies from stimulus to austerity budget policies while unemployment levels were still elevated in many countries.

“IMF advocacy of fiscal consolidation proved to be premature for major advanced economies, as growth projections turned out to be optimistic” its said at the time.

Ms Lagarde said today: “As we reflect upon this extraordinary time, and upon our work to restore stability and quell a potentially larger crisis, we will continue to strive to do even better and to further refine our responses as we evolve as an institution. We must constantly aspire to do better in avoiding crises, managing crises, and learning from the past.”