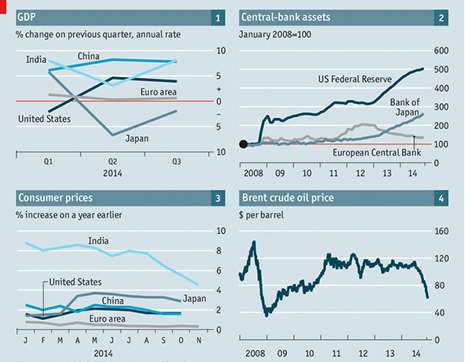

In response the Federal Reserve called off “quantitative easing”, but the Bank of Japan expanded it. The European Central Bank sat on its hands (chart 2).

Despite central banks’ efforts, inflation fell everywhere, to worryingly low levels in the euro zone in particular. A rise in Japan’s sales tax flattered its numbers (chart 3).

One reason for falling inflation was the plunging oil price. Thanks both to limp demand and buoyant supply, it fell by about half (chart 4).

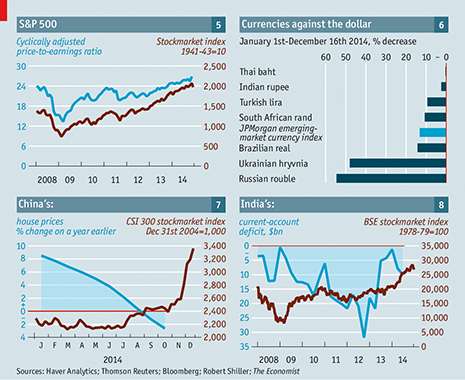

Faster growth and cheaper oil helped propel America’s stockmarket to several new records during the year. Share prices have been rising faster than profits (chart 5).

Oil exporters suffered particularly severe falls in their currencies (as did Ukraine, after Russia’s invasion). Confidence in most emerging markets slipped (chart 6).

Although growth remained subdued by Chinese standards and property prices began to fall, China’s stockmarket surged.

(chart 7).

India’s stockmarket rose sharply thanks to Narendra Modi’s election win and to the shrinking current-account deficit, a product of the falling oil price (chart 8).

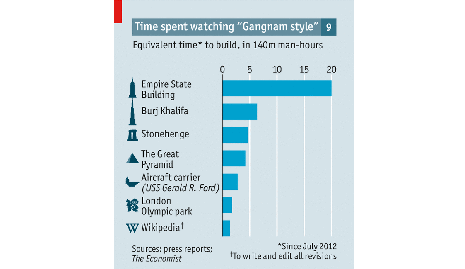

The most popular chart on The Economist’s site looked at what could have been achieved in the time the world spent watching a South Korean pop video (chart 9).