Yen bears are taking note. Australia & New Zealand Banking Group Ltd., which was among the top forecasters of the currency last quarter, cut its year-end forecast to 110 per dollar from 105. Lee Ka Shao, a former hedge-fund manager who runs his own family office in Singapore, started putting on positions Wednesday to bet on the decline of the Japanese currency, after profiting when it rallied on prospects for a Trump win.

“After the dust settles, the yen will most likely start weakening,” said Nader Naeimi, who heads a dynamic investment fund for $119 billion asset manager AMP Capital Investors Ltd. in Sydney and is holding on to his bets for a weaker Japanese currency. A Trump administration will boost spending and spur U.S. economic growth, weighing on the yen versus the dollar, he said. “The yen is expensive now, it’s crowded.”

Few saw the world’s third-most traded currency weakening immediately after a Trump victory. A majority of analysts surveyed before the election said the yen would surge to 100 per dollar in that scenario, and it did initially rally to peak at 101.20, before a U-turn that sent it to 106.95 on Thursday, the weakest since July 21. It also closed below its 200-day moving average for the first time this year.

Treasuries suffered their steepest two-day slump in almost six years as president-elect Trump is seen ramping up spending to boost the economy, potentially widening the budget deficit and stoking inflation. The extra yield 10-year U.S. debt offers over similar-dated Japanese securities jumped 0.35 percent point this week, the most since June 2013, to 2.2 percentage points. The market-implied probability of a December interest-rate increase by the Federal Reserve jumped above 80 percent, after falling to less than 50 percent as election results showed Trump winning the presidential race.

The U.S. central bank will likely tighten policy in December, before Trump is sworn in, according to Lee, the former co-founder of hedge fund Cavenagh Capital, which was backed by the biggest Dutch pension fund.

He covered all his “Trump win risk-off bets” in currencies and equity indexes Wednesday as the yen rallied and U.S. stock-index futures tumbled when early results signaled Trump might win. Lee, who trades his own money and that of his wealthy clients, then put on a bet the Japanese currency would decline once the rally took it to 101.30 per dollar. The yen has been unable to sustain its gains past 101 to 101.50 in the last four months, he said.

“If the Fed does not act, it will only make markets wonder why they are so worried about a Trump presidency and acting on such concerns even before he takes office,” Lee said.

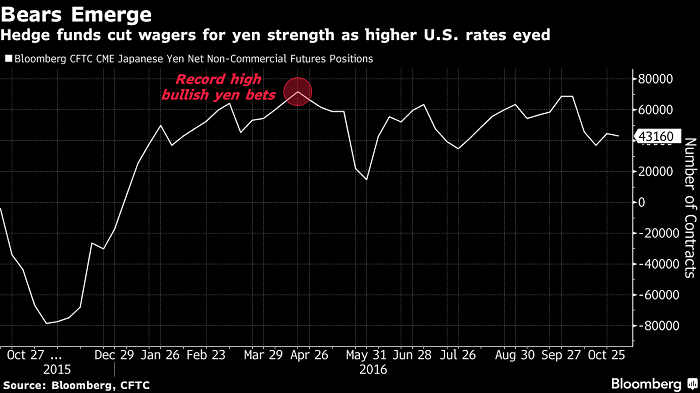

Still, the Japanese currency has rallied on at least six occasions this year to unwind declines, and yen bulls are pulling in their horns. Eisuke Sakakibara, the Asian nation’s former top currency official, says it may climb to 90 per dollar within six months because the new U.S. president won’t want a strong greenback.

“Trump’s ‘America first’ stance means weak dollar policies,” the 75-year-old professor, dubbed “Mr. Yen” for his ability to influence the exchange rate in the 1990s, said in an interview Thursday in Tokyo. “Gradual dollar weakness and yen strength are going to continue.”

The yen’s slide this week has pushed the currency below consensus forecasts for the end of 2016 levels by the most in three years, data compiled by Bloomberg, though few strategists have changed their calls since the election.

ANZ lowered its forecasts for the yen because a recovery in commodity prices will reduce the scale of Japan’s trade surplus and global volatility should be contained, encouraging Japanese investor outflows, said Daniel Been, Sydney-based head of foreign-exchange research at ANZ. An increase in real rate differentials between the U.S. and Japan will also weaken the yen, he said.

ANZ now predicts a further drop to 115 in 2017, reversing a bullish projection of 100.

“In a fundamental sense, the yen looks set to turn,” Been said. “The risks for dollar-yen are now skewed higher.”

-1741945056.jpg&h=120&w=187&zc=1&q=70')

-1741856732.jpg&h=120&w=187&zc=1&q=70')